Texas Income Tax Rate 2025. You can quickly estimate your texas state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare. From 1 july 2025, the.

Use the income tax estimator to work out your tax refund or debt estimate. You pay tax as a percentage of your income in layers called tax brackets.

2025 federal income tax brackets and rates overview by filing status , age and adjusted gross income.

Tax Rates 2025 To 2025 Image to u, These changes are now law. The texas income tax has one tax bracket, with a maximum marginal income tax of 0.000% as of 2025.

T200018 Baseline Distribution of and Federal Taxes, All Tax, The federal income tax has seven tax rates in 2025: From 1 july 2025, the.

T220078 Average Effective Federal Tax Rates All Tax Units, By, Every two years, legislators decide how to allocate our tax dollars to the services and infrastructure that allow us to thrive. Find out how much you'll pay in texas state income taxes given your annual income.

T230017 Distribution of Individual Tax on LongTerm Capital, This tax return and refund estimator is for tax year 2025 and currently based on 2025/2025 tax year tax tables. “the state’s warm climate is a major.

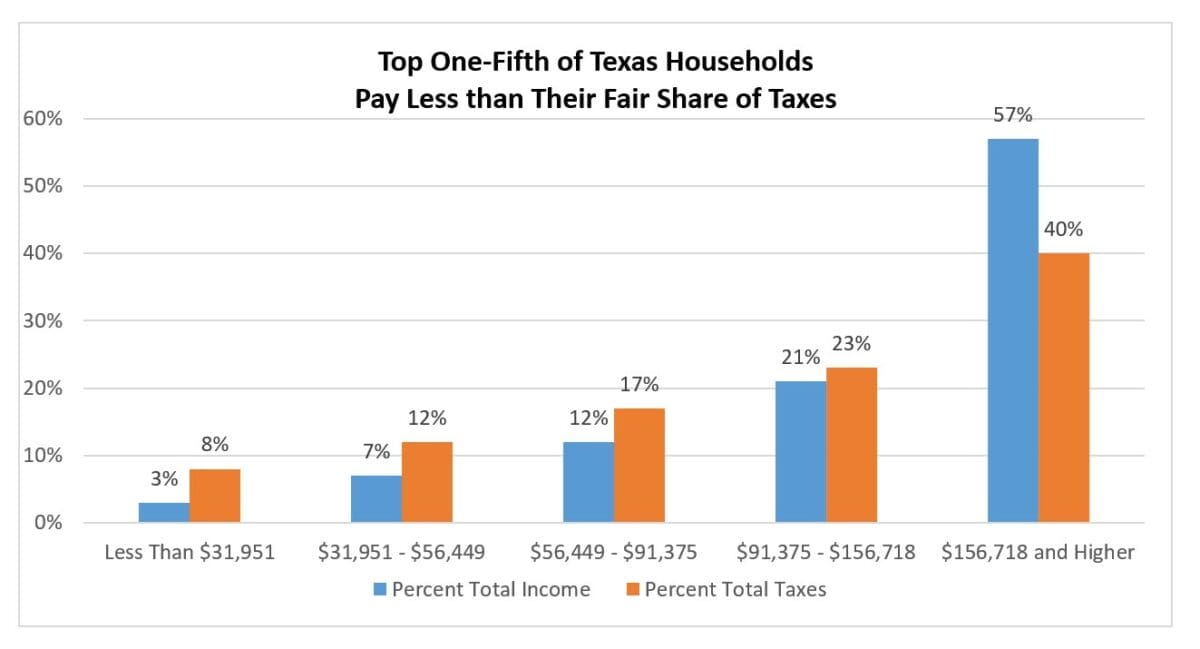

Who Pays Texas Taxes? Every Texan, Every two years, legislators decide how to allocate our tax dollars to the services and infrastructure that allow us to thrive. The other states without an individual income tax are:

Historical Chart Of Tax Rates, Texas is one of seven states that don’t have an individual income tax. On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025.

Tax Rates 2025 2025 Image to u, Rate from 4.4 percent to 3.9 percent, effective tax year 2025. The combined tax percentage usually ranges from 15% to 30% of your.

T210209 Distribution of Individual Tax on LongTerm Capital, The federal income tax has seven tax rates in 2025: As your income goes up, the tax rate on the next.

2025 Tax Brackets Texas Myrle Tootsie, From 1 july 2025, the. Different terms may apply for ai features provided by third.

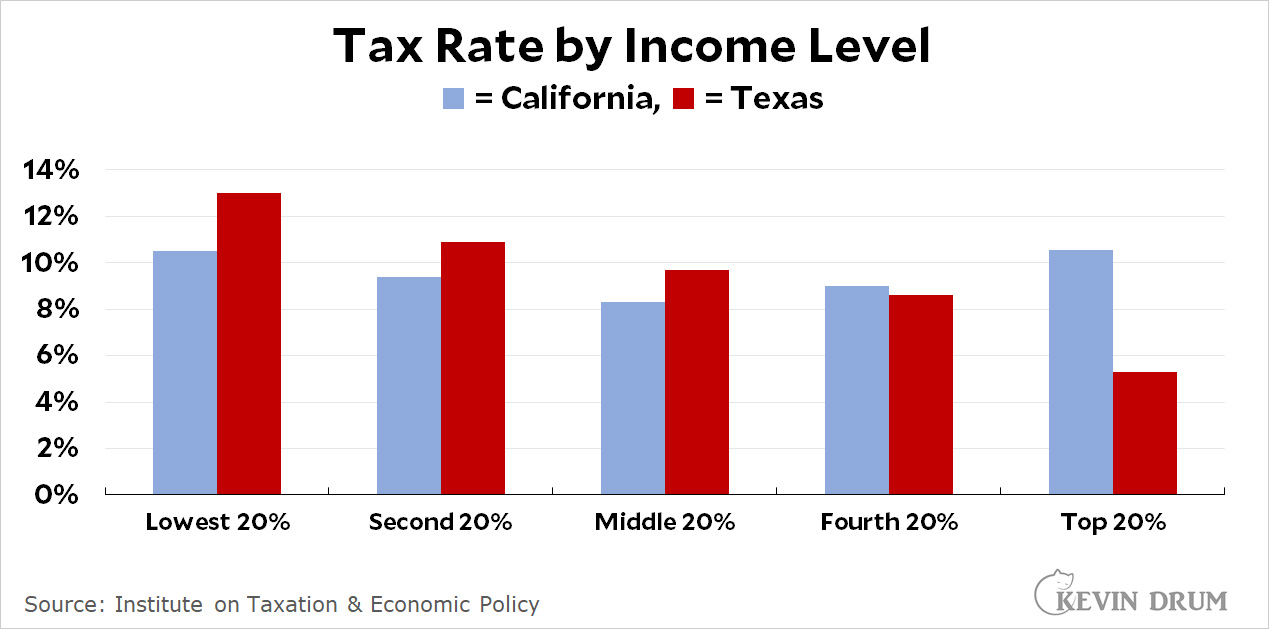

Texas has lower taxes than California . . . for some people Kevin Drum, On 25 january 2025, the government announced changes to individual income tax rates and thresholds from 1 july 2025. Use the income tax estimator to work out your tax refund or debt estimate.

The 2025 tax rates and thresholds for both the texas state tax tables and federal tax tables are comprehensively integrated into the texas tax calculator for 2025.