Bir Withholding Tax Compensation 2025. To estimate the impact of the train law on your compensation income, click here. If additional compensation such as commission, honoraria and other allowances are entered in the next box (for taxable compensation income), the withholding tax due will.

To calculate income tax for ₱35000 salary in the philippines we need to determine the taxable income, check the compensation range, and then apply the prescribed. The tax rate applicable on income by way of royalty and fees for technical services earned by non.

Individuals benefit from a distributed tax payment approach, reducing the financial burden of settling large tax amounts at once.

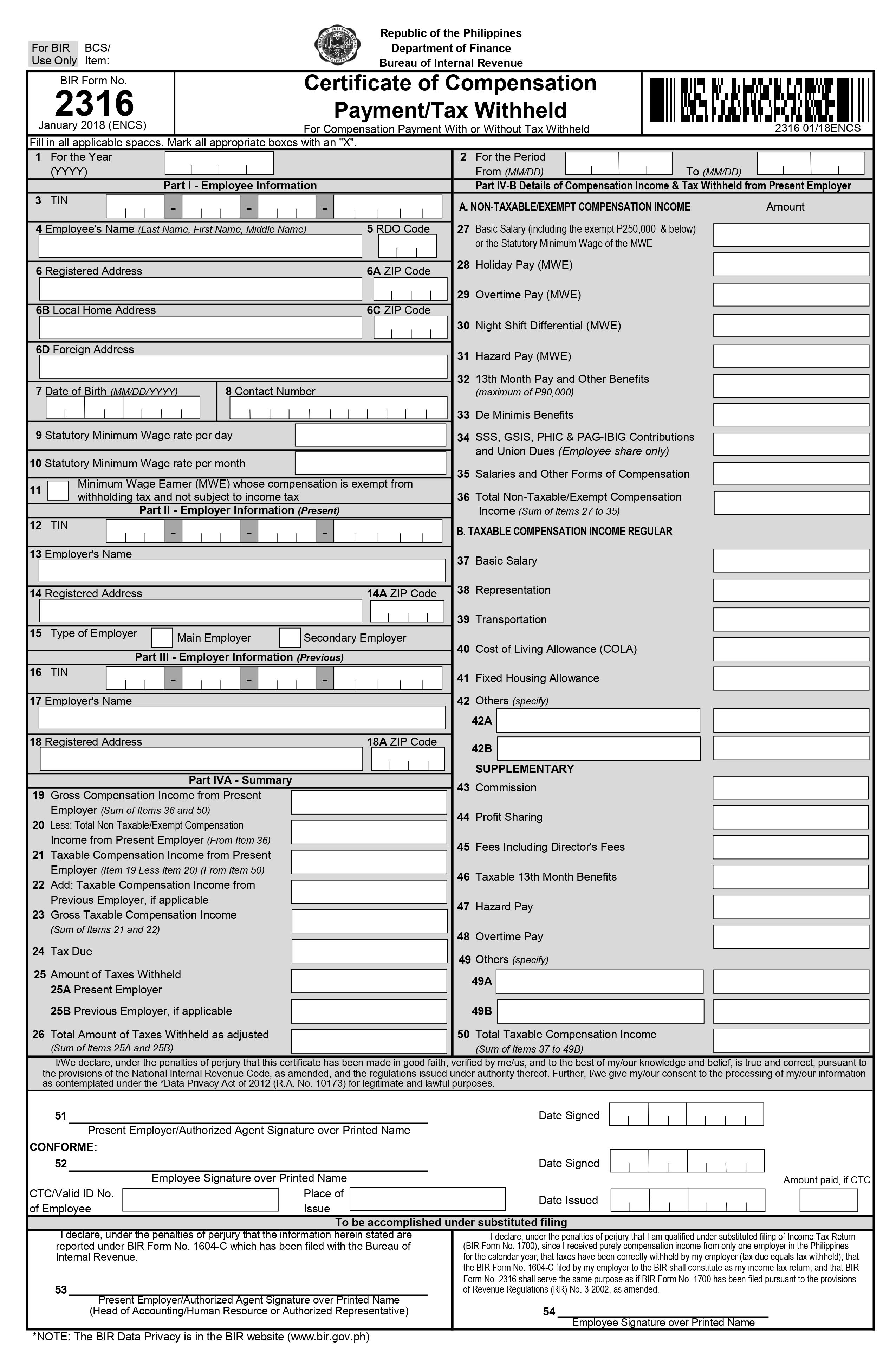

Philippine Tax Bracket 2025 Gerti Petronella, Certificate of income tax withheld on compensation ( bir form 2316 ), if applicable. This comprehensive guide will walk you through the process of filing annual withholding taxes with the bir, including who needs to pay expanded withholding tax,.

New Certificate of Compensation Payment/Tax Withheld (BIR Form No. 2316, This comprehensive guide will walk you through the process of filing annual withholding taxes with the bir, including who needs to pay expanded withholding tax,. To access withholding tax calculator click here.

New Certificate of Compensation Payment/Tax Withheld (BIR Form No. 2316, The tax rate applicable on income by way of royalty and fees for technical services earned by non. Bir form 0619e (called monthly remittance forms for expanded withholding taxes) and bir form 1601eq (called quarterly remittance forms for expanded.

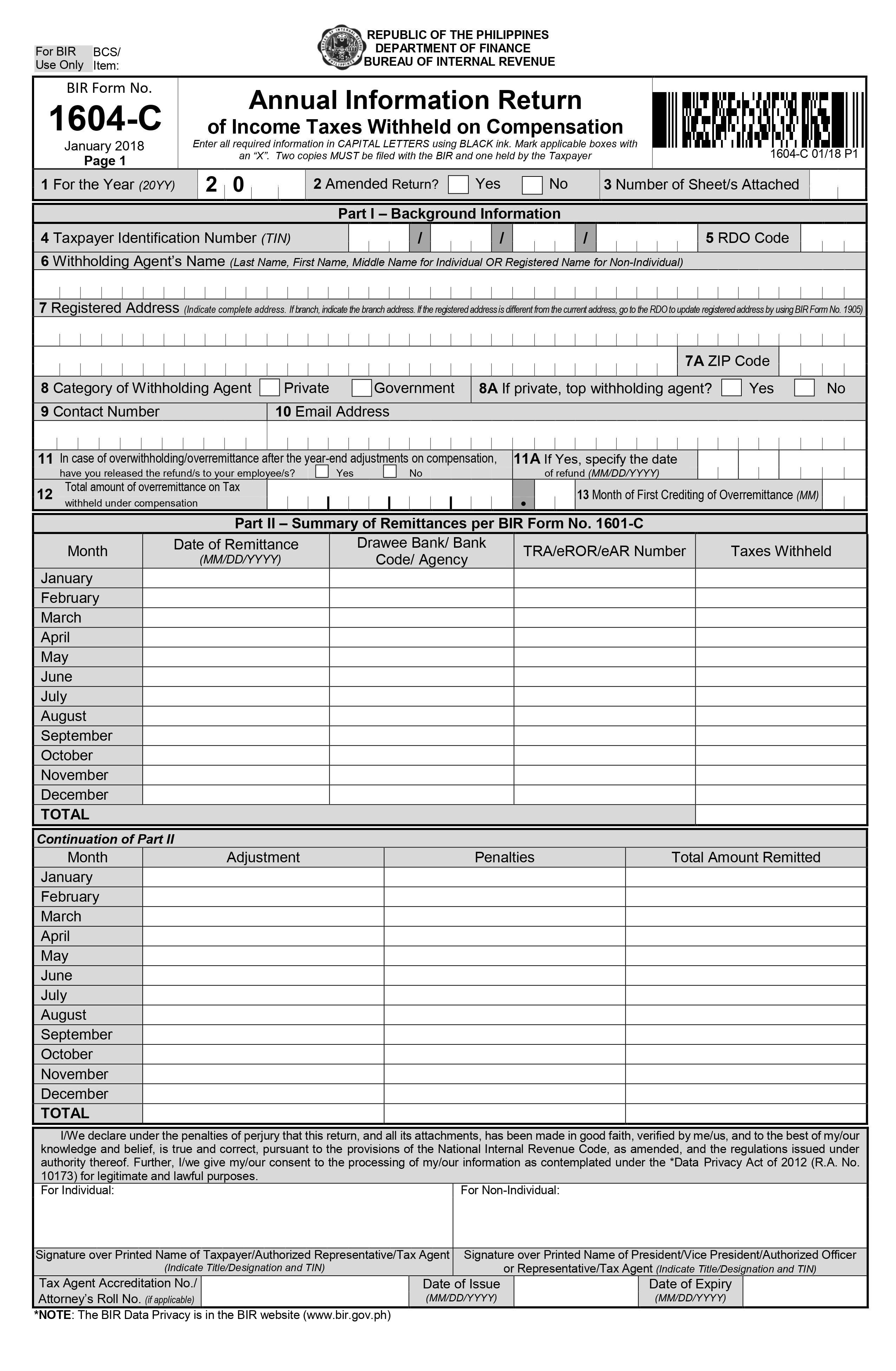

What You Need To Know About BIR Form 1604C?, Certificate of income payments not subjected to withholding. This comprehensive guide will walk you through the process of filing annual withholding taxes with the bir, including who needs to pay expanded withholding tax,.

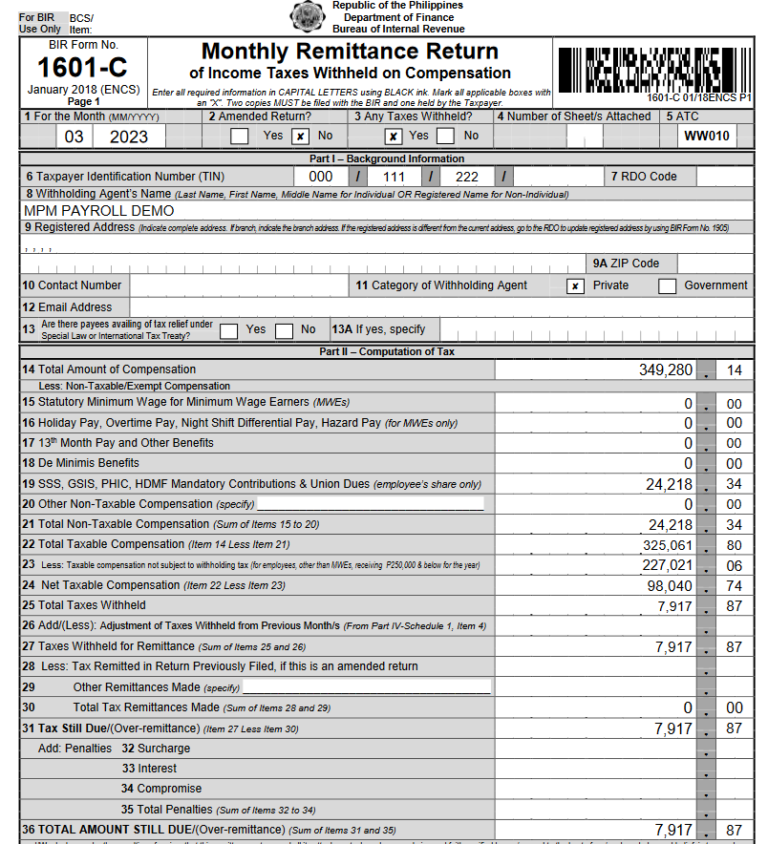

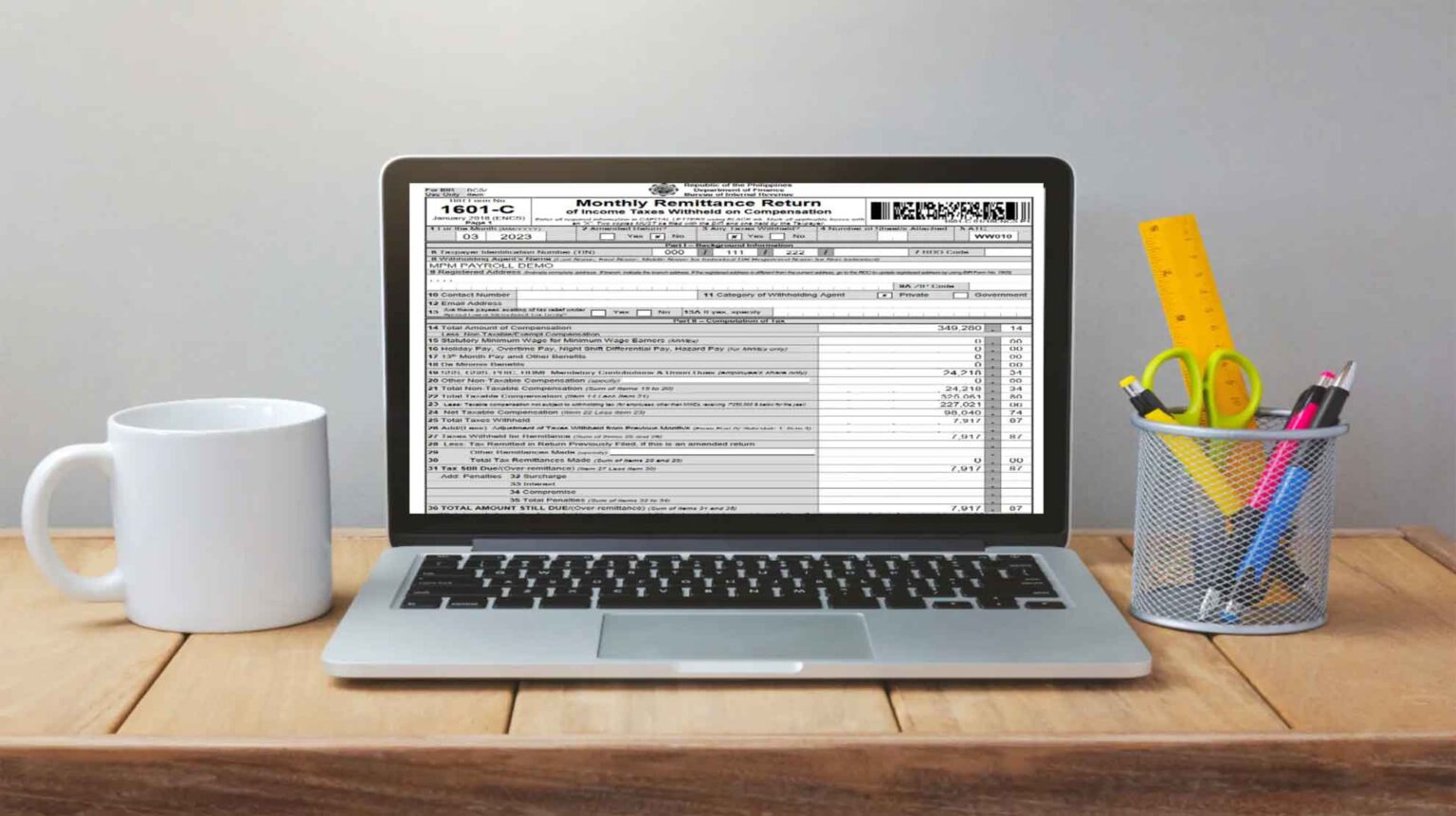

BIR Form 1601C Monthly Withholding Tax on Compensation, This return shall be filed in. 0619e, to comply with philippine.

2025 BIR TAX Compliance Reminders (MUST WATCH!) 😲 YouTube, Changes in tax on royalty and fees for technical services. The three different forms on this package include forms 0619f, the updated 1701q, and 0619e.

Form 1604C, For inquiries or suggestions on the. Bir released forms package version 7.1 back in may 2018.

BIR Form 1601C Monthly Withholding Tax on Compensation, Bir form 0619e (called monthly remittance forms for expanded withholding taxes) and bir form 1601eq (called quarterly remittance forms for expanded. Individuals benefit from a distributed tax payment approach, reducing the financial burden of settling large tax amounts at once.

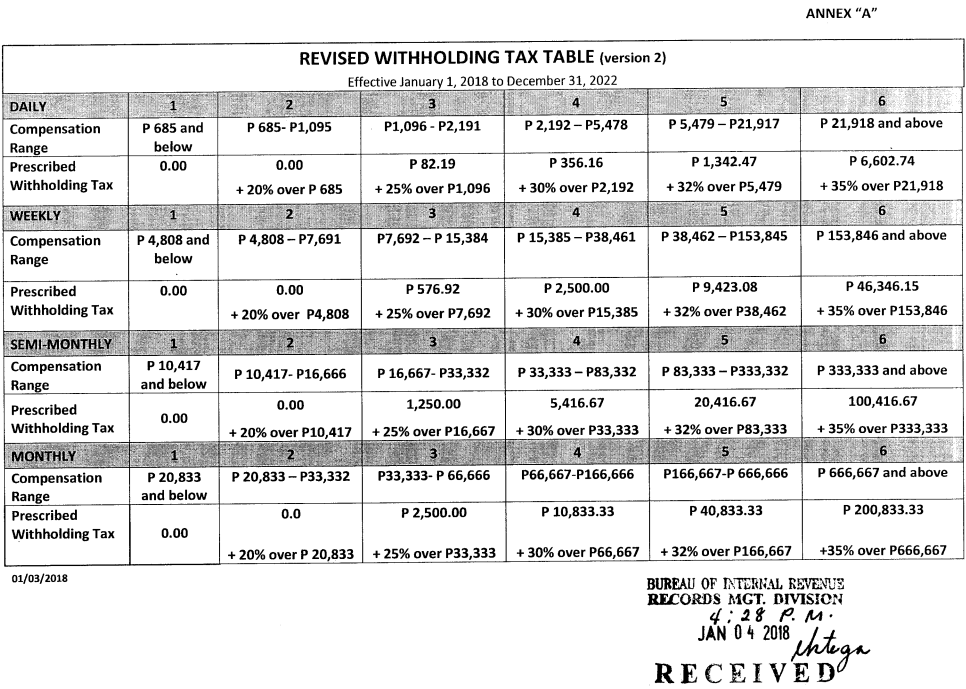

Revised Withholding Tax Table Bureau of Internal Revenue, Changes in tax on royalty and fees for technical services. This return shall be filed in.

Form 2316, Please note that this is just a basic listing and should not be taken as complete or accurate. Professionals and freelancers must diligently withhold and remit expanded withholding tax (ewt) monthly, using bir form no.

This comprehensive guide will walk you through the process of filing annual withholding taxes with the bir, including who needs to pay expanded withholding tax,.

The bfp paid the suppliers p2.44 billion, excluding the 15% advance payment of p386.59 million, the 1% withholding tax amounting to p23.01 million, and 5% value.